The Claimocity Blog

Inpatient Billing Cheat Sheet:

3 CPT Risks + 3 Tips

Decoding the Superbill: 2024 CPT Edition

Inpatient superbills transmit key data to insurance companies, facilitating proper payments for physicians. They are a vital component in the physician reimbursement process, providing the data for medical services claims and sharing everything necessary for payment approval.

2024 CPT CODING GUIDELINES

CPT stands for Current Procedural Terminology and categorizes the medical procedures performed in a patient encounter. CPT codes are medically standardized through the AMA.

Medical coding violations are considered fraud and can be the basis for costly audits, civil fines, criminal penalties, exclusion from Federal programs, loss of state medical licenses, Qui Tam False Claims Act lawsuits, and other brutal legal and financial ramifications.

No intent is required for fraud, so mistakes can be as damaging as malicious manipulations of the system.

Summary of AMA Changes

The AMA has changed the E/M coding guidelines, making past updates obsolete.

Here are the top four changes.

- Addition of Spanish language descriptors for over 11,000 medical procedures and services.

- Consolidation of over 50 previous codes for COVID-19 immunizations.

- Creation of five new CPT codes for product-specific RSV immunizations.

- Removal of time ranges from certain E/M visit codes and alignment with other E/M codes.

But before we go into depth on these changes, here are the top 3 CPT risks to avoid in 2024 and the impact they have on revenue and risk.

Risk 1: Avoidable Denials

- Denial rate is up 23% since 2016

- CPT coding is the third most common reason for denials

- New data shows that 86% of denials are potentially avoidable

- 24% (1 in 4) of those avoidable denials can’t be removed

Summary: Denials are up and climbing, CPT coding is a big reason for claim rejections, and getting submissions right the first time avoids a ton of costly denials.

Follow Up Fact: Inpatient practices paying 5-8% on average for billing services showed significantly lower denials and better revenue per encounter (1.3-1.8x higher ROI) than the practices in the 2-4% range.

Risk 2: Downcoding

- 33% of inpatient MDs lose significant revenue to downcoding

- The average loss is up 56% in the last 10 years and growing

- Undercoding is triggering the same fraud audits as overcoding

What is Downcoding? Undercoding, or downcoding, occurs when the CPT selected indicates a lower level of service than was performed (documented) or when the reported procedural code fails to cover the full array of services provided.

Summary of Findings: A decade ago, “the American Academy of Professional Coders (AAPC) conducted a review of 60,000 physician billing audits in 2012, they found that more than a third of the records were either under coded or under documented. That represented an average of $64,000 in foregone or at-risk revenue per physician.”

That number has gone up by 56% in the last ten years as a 2024 Medicare Data Study in the National Library of Medicine (NIH/NLM) “asserts that individual physician practices could sacrifice as much as $100,000 annually to undercoding.”

Part of this issue is an instinctive decision by physicians who, when in doubt, opt for the safe approach and undercode to avoid the increased audit risks that come from overcoding. Yet by “playing it safe” doctors are opening themselves up to downstream fraud audits and immediate heavy revenue losses.

Risk 3: Upcoding

- 1 in 4 patient physicians code well above CPT benchmarks

- Provider coding audits for overcoding are up 31% since 2021

The CMS, DOJ, HHS, and OIG are working together using AI pattern analysis and E/M benchmarking tools.

What is Upcoding? Overcoding, or upcoding, is defined as reporting inaccurate CPT (or HCPCS) codes that generate higher payments than warranted for services provided. Intention is irrelevant.

Summary of Findings: Recent studies show that roughly a quarter of hospital and facility-based physicians consistently overcode above allowable thresholds.

The CMS now works with the Department of Justice (DOJ), Department of Health and Human Services (HHS), and the Office of the inspector General (OIG) to scrutinize claims (and coding patterns) through predictive modeling and artificial intelligence (AI) tools.

CMS data analysts warn of a new wave of crackdowns as healthcare provider audits are up 31% since 2021. The federal government is serious about overcoding and there is a heightened focus on combatting fraud which puts the scrutiny squarely on providers who are showing deviations from efficient E/M coding and benchmark levels.

Tip: Use ONLY 2024 Guides

IMPORTANT NOTE: Using any inpatient billing cheat sheet from 2020, 2021, or 2022 will result in costly errors, denials, coding inefficiency, audit risks, lower peer rankings, and lost revenue.

In 2021-2022, appropriate CPT codes were dependent upon a combination of factors with varying levels including a combination of 1-3 or 4:

- History

- Physical Examination

- Medical Decision-Making (MDM)

- OR Time

To make matters more complex, “History” had four separate degrees of severity from problem focused to comprehensive and “MDM” had four degrees of severity from straightforward to high (with differing definitions per type), and “Time” was only available in certain encounter types and context.

For example, a 99222 initial inpatient visit in 2021 required:

- A comprehensive history and exam, and moderate MDM

- OR 50 minutes of floor time

While a 99223 initial inpatient service (one step up) required:

- A comprehensive history, comprehensive exam, and high MDM

- OR 70 minutes of floor time

Update: Changes to History and Exam

The AMA made significant changes to the CPT Evaluation and Management (E/M) Code and Guideline process.

While History and Physical Exam are still very much a required part of the encounter and documentation process to avoid denials, they are no longer factors in the CPT coding process as the AMA 2024 guideline states that “the extent of history and physical examination is not an element in selection of the level of E/M service codes.”

That reduces the E/M coding variables to:

- Medical Decision Making (MDM)

- Or Time

The AMA guideline instructs to select the appropriate level of E/M services based on EITHER the level of MDM (as defined for each service) OR the total time for E/M services on the date of the encounter.

From the prior example, that same 99222 in 2024 is now:

- Moderate MDM

- Or 55 Minutes

Along the same lines, the 99223 in 2024 is:

- High MDM

- Or 75 Minutes

Update: 99418 CPT Prolonged Billing

In 2022, inpatient billing CPT codes 99356-99357 were used to report prolonged medical services, but they have been replaced by a single inpatient add-on code (99418) to bill for additional increments of 15 minutes.

A 99418 is submitted IN ADDITION TO the highest level of code in that type/family when using total time for CPT selection.

Important Note: Multiple 99418’s can be reported per encounter. Each 99418 represents a 15-minute increment of prolonged service time beyond the highest level of code in that type/family.

Example:

- A 56-minute follow up (subsequent) inpatient visit would generate a 99233 CPT code.

- A 71-minute follow up would bill as: 99233 + 99418.

- An 84-minute follow up would be: 99233+ 99418 + 99418.

Update: Changes to Observation Care

In 2024, observation care codes have been collapsed into inpatient codes, creating a single guideline for Inpatient and Observation Care.

Change 1: The observation care E/M code groups (99217-99220 and 99224-99226) have been deleted.

Change 2: The hospital inpatient code groups (99221-99223 and 99231-99239 and 99252-99255) have been updated to include observation care services.

Tip: E/M Benchmarks Reveal Audit Risks

The best way to ensure you are within reasonable levels of appropriate and consistent CPT coding is through E/M benchmarking which shows your “peer ranking” by specialty, location, code groups, and more.

Because CMS uses AI tools and benchmarking analysis to target audits, having better coding efficiency than your peers will not only help ensure optimal revenue but significantly reduce legal risk.

Option 1: There are some E/M utilization benchmarking tools but they are often problematic and require sharing private financial data.

Option 2: Some combo charge capture + RCM platforms like Claimocity have E/M benchmarking data baked into their reporting, allowing you to assess deviations, exposure, and revenue losses.

Tip: Be Wary of 2-4% RCM Rates

In 2024, paying less = earning less!

The Problem: Advanced claim data studies now indicate that 1.9-4.1% RCM rates generate 1.3-1.8x lower billing ROI on average.

Data sample aggregate:

- 5% RCM rate generates 280k

- $9,800 paid for billing

- $270,200 collected

- 5% RCM rate generates 370k

- $20,350 paid for billing

- $349,650 collected

Paying $10,550 more adds $79,450.

This is on the lower end of the multiplier for inpatient providers, meaning that saving a few thousand up front is costing practices hundreds of thousands on the back end.

The Solution: Don’t get stuck on the rate. Be willing to spend more to get more. Demand accountability and A/R transparency. Utilize a high-end inpatient RCM service provider and request an initial audit, projections of collections to expect, and E/M coding reviews to ensure your practice and providers stay in the 99th percentile for coding efficiency.

For hospital and facility-based practices, use a top-level inpatient billing service that specializes in inpatient and SNF billing.

Inpatient/SNF Specialties: Internal medicine, infectious disease, critical care, physical medicine and rehabilitation, hospital psychiatry, emergency medicine, inpatient cardiology, hospital nephrology, inpatient pulmonology, hospitalists, and other inpatient doctors who round in acute care hospitals or sub-acute step-down facilities.

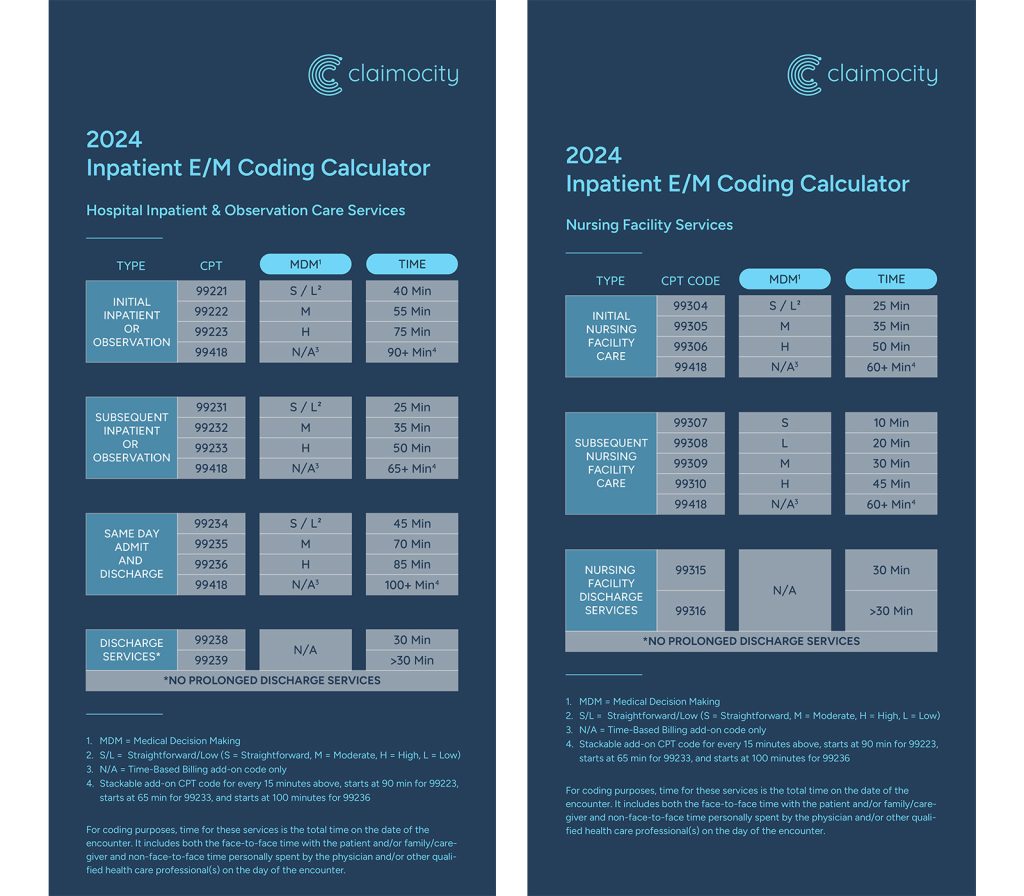

Downloadable 2024 CPT Cheat Sheets

Inpatient Cheat Sheet: INPATIENT SHEET

Nursing Facility Cheat Sheet: SNF SHEET

Citations

1. Farnen H. The Financial Impact of Denied Claims in Medical Billing: Bigger . RXNT. www.rxnt.com/the-financial-impact-of-denied-claims-in-medical-billing/. Published August 3, 2024.

2. Poland L, Harihara S. Claims Denials: A Step-by-Step Approach to Resolution. Journal of AHIMA. ahima-journal.prod.itswebs.com/page/claims-denials-a-step-by-step-approach-to-resolution. April 25, 2022.

3. Most Common Medical Billing and Coding Errors. AIHT Education. aiht.edu/blog/most-common-medical-billing-and-coding-errors/.

4. Coustasse A, Layton W, Nelson L, Walker V. Upcoding Medicare: Is Healthcare Fraud and Abuse Increasing. Perspect Health Inf Manag. 2021;18(4):1f. Published 2021 Oct 1.

5. Tenpas A, Dietrich E. The Fermi problem: Estimation of potential Billing losses due to Undercoding of Florida Medicare data. Explore Res Clin Soc Pharm. 2024;9:100238. Published 2024 Mar 6. doi:10.1016/j.rcsop.2024.100238

6. Top 10 Causes of Denials in Medical Billing. LinkedIn. December 8, 2022. https://www.linkedin.com/pulse/top-10-causes-denials-medical-billing-trucare-billing.

7. American College of Healthcare Executives. The Change Healthcare 2020 Revenue Cycle Denials Index.

8. Vogel, Slade, & Goldstein. Medical Coding Fraud. VSG Law. www.vsg-law.com/practice-areas/false-claims-act-healthcare-fraud/coding-fraud/.