Claimocity Claims

In House vs Outsourced Billing Services:

Inpatient MD Guide

SUMMARY POINTS

-

Journal of Medical Practice Management (2018): Outsourced billing achieves an 80% first submission payment rate versus 68% for in-house billing.

-

Same study: Outsourced billing records an 88% payment rate within 30 days, surpassing the 72% rate of in-house billing.

-

MGMA survey (2021): Outsourced billing incurs a 5.4% cost to collect a dollar, compared to 13.7% for in-house billing.

-

Globe News Wire: Medical billing outsourcing market to grow by $11.7 million (2022-2027), with a projected 70% market share, outpacing in-house billing.

WHY Read This Guide

This deeper dive into billing and coding was put together over months of collaboration and surveys from billing companies, in-house billing teams, industry insiders, third party researchers, medical trend forecasters, data-science specialists, RCM experts, coding auditors, practice managers, and end users.

This is a data-driven report based on scientific studies, case studies, KPI metrics, and layered perspectives ranging from industry insider topics to use-case scenarios.

The goal is to provide both beginners and advanced users with a comprehensive understanding of key decision-driven insights as well as a fair and balanced overview. The information should help generate a better ability to maximize billing solution selection and value and help negotiate rates with outsourced services.

Defining Key Terms

- In-House Medical Billing

- Hospitalist Billing

- Outsourced Medical Billing

- Clearing House

What is In-House Medical Billing?

In-house medical billing (transitive verb) refers to the process of managing the medical billing and coding operations within a healthcare organization, such as a hospital or medical practice, using internal staff and resources. In-house medical billing typically involves the use of specialized software and technology to generate bills, process claims, and manage payments and denials.

What is Hospitalist Billing?

Hospitalist billing (transitive verb) refers to the medical billing and coding services provided for hospitalists, who are hospital-based physicians specializing in the care of hospitalized patients. Hospitalist billing involves the submission of claims to insurance companies and other payers for the services provided by hospitalists, such as hospital visits, consultations, and coordination of care with other healthcare providers. Hospitalist billing requires a thorough understanding of complex coding and billing rules and regulations, as well as an ability to communicate effectively with insurance companies and other payers to ensure timely reimbursement for services provided. Effective hospitalist billing practices are critical to the financial success of hospitals and other healthcare organizations that rely on hospitalists to provide high-quality care to their patients.

How Does Outsourced Medical Billing Work?

Outsourced medical billing (transitive verb) is a process where a healthcare organization, such as a hospital or medical practice, hires an external company to handle their medical billing and coding operations. This external company, also known as a medical billing service, typically has specialized expertise in medical billing and coding, and uses sophisticated technology to manage the billing process. The outsourced medical billing service typically handles all aspects of the billing process, including generating bills, submitting claims, managing payments and denials, and addressing billing inquiries and disputes.

What is the Role of the Clearing House in Medical Billing?

Clearinghouse (noun) in the context of medical billing is an intermediary entity that processes electronic claims and transactions between healthcare providers (such as hospitals or medical practices) and insurance companies or other payers. Clearinghouses receive electronic claims from providers, verify the accuracy and completeness of the claims, and then forward them to the appropriate payer for payment. Clearinghouses also receive electronic remittance advice (ERA) from the payer, which is used to reconcile accounts receivable and manage denials and appeals.

Clearinghouses may also provide additional services such as eligibility verification, prior authorization management, and patient statement processing. Clearinghouses can help streamline the medical billing process, reduce errors and rejections, and improve payment accuracy and timeliness. By using a clearinghouse, healthcare providers can avoid having to deal with multiple payers directly and can instead work with a single intermediary that handles claims processing and payment reconciliation across multiple payers.

Related Terms

- Hospitalist billing services

- Hospitalist billing software

- Outsourced medical billing statistics

- Types of clearing house in medical billing

- Medical billing KPI metrics

- Medical billing metrics

Among the related terms discussed, only medical billing KPI metrics and types of clearinghouses in medical billing merit deeper exploration. Selecting the appropriate KPIs is crucial because some data may appear favorable but fail to accurately represent the overall revenue cycle health, while other less impressive data can offer clearer insights into areas of success or failure. The choice of KPIs reflects both the quality of analytics available to the biller and the industry knowledge of the requester. KPIs will vary between practices and may evolve over time in response to ongoing issues or identifiable areas of underperformance within the revenue cycle.

key metrics for medical billing

- Clean claim rate: This measures the percentage of claims that are processed without errors or rejections. A high clean claim rate indicates efficient billing processes, and a low rate suggests billing errors that need to be addressed.

- Reimbursement rate: This is typically an internal process analytic used to evaluate the percentage of revenue collected against the total revenue possible. Industry average hovers between 85-89%.

- Days in accounts receivable (AR): This metric measures the average number of days it takes for a provider to receive payment after submitting a claim. A lower AR indicates better cash flow management.

- Collection rate: This metric measures the percentage of outstanding balances that are collected. A high collection rate indicates effective collection processes, and a low rate suggests a need for improvement.

- Denial rate: This measures the percentage of claims that are denied by insurance companies. A high denial rate can indicate issues with coding or documentation and may lead to longer AR days and lower revenue.

- Net collection rate: This metric measures the percentage of billed charges that are collected. A high net collection rate indicates effective revenue cycle management, and a low rate suggests a need for improvement.

- Average reimbursement per claim: This measures the average amount paid by insurance companies for each claim. A higher average reimbursement rate suggests that providers are charging appropriately for their services.

- Cost to collect: This metric measures the cost of collecting payments from patients and insurance companies. A lower cost to collect indicates efficient billing processes.

What are types of clearing houses in medical billing?

-

Commercial clearinghouses: These are privately owned companies that provide electronic claims processing services to healthcare providers for a fee. They usually offer a wide range of services, including eligibility verification, claim submission, and payment posting.

-

Government clearinghouses: These are those owned and operated by government entities, such as Medicare or Medicaid. They are typically used for processing claims related to government-sponsored healthcare programs.

-

Integrated delivery network (IDN) clearinghouses: These are ones owned and operated by healthcare systems or hospitals. They are used to process claims for multiple facilities within the network, streamlining the billing process and reducing administrative costs.

-

Specialty clearinghouses: focus on specific areas of healthcare, such as dental or behavioral health. Healthcare providers may choose to use one or more clearinghouses depending on their specific needs and the insurance plans they work with.

Notable Statistics

It’s important to note that these statistics may vary depending on the size and specialty of the practice, as well as other factors such as the complexity of the billing process and the effectiveness of the practice’s billing procedures.

- According to a survey by the Medical Group Management Association (MGMA), in 2020, 46% of medical practices reported that they handle their medical billing in-house.

- According to a survey conducted by the Medical Group Management Association (MGMA) in 2021, practices with less than five full-time equivalent (FTE) billing employees had a 14.7% cost to collect, compared to 12.6% for practices with more than five FTEs.

- The same MGMA survey found that practices that outsource their billing had a higher percentage of clean claims (96.5%) than practices that handle their own billing (94.5%).

- A study published in the Journal of the American Medical Association (JAMA) found that physician practices spend an average of 15.5 hours per week on billing and insurance-related activities.

- The same JAMA study found that medical practices spend an average of $99,000 per year on billing and insurance-related activities.

- A survey by the American Medical Association (AMA) found that 78% of physicians reported experiencing prior authorization burdens, which can add to the workload of in-house billing staff.

- According to the MGMA survey, the top challenge faced by medical practices that handle their billing in-house is managing changing reimbursement rules and regulations, followed by denials management, and staying up to date with coding changes.

- A study published in the Journal of the American Medical Association (JAMA) in 2014 found that physician practices spent an average of 3.3 hours per physician per week on billing and insurance-related activities.

- The same JAMA study found that practices with fewer than five physicians spent a higher percentage of their total revenue on billing and insurance-related activities (about 15%) than practices with more than 20 physicians (about 10%).

- Another survey conducted by the Healthcare Financial Management Association (HFMA) in 2020 found that 53% of healthcare organizations handle their billing in-house, while 31% outsource their billing to a third-party vendor.

Advantages and Drawbacks of In-House Billing

ADVANTAGES

Here are some advantages of high-quality in-house medical billing:

- Control and customization: By handling medical billing in-house, healthcare organizations have complete control over the billing process and can customize it to their specific needs. They can also make changes quickly if needed.

- Cost-effectiveness: In some cases, in-house medical billing can be more cost-effective than outsourcing to a third-party vendor, especially for larger healthcare organizations with established billing processes and the resources to invest in large billing teams.

- Better coordination: In-house billing staff are more closely integrated with other parts of the healthcare organization, which can lead to better coordination and communication between departments.

- Specialized revenue: In-house billing staff have the luxury of specializing in a single organization’s revenue cycle, allowing for greater familiarity that can identify and address potential revenue leaks more effectively. This can result in increased revenue and improved financial performance.

- More accurate coding: With access to the charts for verification and follow up purposes, in-house billing staff can ensure that the correct codes are used for medical procedures and services, reducing the risk of errors and denials.

- Better compliance: In-house billing staff can ensure that the organization is compliant with all relevant regulations and standards, reducing the risk of legal and financial penalties.

High-quality in-house medical billing provides healthcare organizations with control, customization, cost-effectiveness, improved patient satisfaction, and financial performance. Outsourcing may be preferable for small to medium practices or those lacking resources or unsuccessful with in-house billing.

DISADVANTAGES

Here are some disadvantages of in-house medical billing:

- Complexity of billing: Hospitalists provide hospital services, some of which are complex to bill and require experience and specialization. Outsourcing medical billing to a vendor with expertise in hospitalist billing may ensure more accurate coding, fewer billing errors, and faster reimbursements.

- Higher overhead costs: In-house medical billing requires a significant investment in staff, technology, and infrastructure. This can result in higher overhead costs for healthcare organizations, especially small to medium practices.

- Staffing challenges: Healthcare organizations must hire and train skilled billing staff to handle in-house billing, which can be expensive and time-consuming. Additionally, it is difficult to discern the successful hires from the unsuccessful hires until a significant investment has been made in time, resources, and training.

- Staff churn: Staff turnover is a common occurrence in the RCM industry and can significantly disrupt the billing process and lead to errors and delays. Hiring and training replacements is a lengthy and costly process that can set the RCM and A/R processes behind by hundreds of thousands very quickly.

- Technology requirements: In-house medical billing requires healthcare organizations to invest in and maintain technology such as billing software, hardware, and IT support. This can be costly and time-consuming, especially for small to medium practices.

- Compliance and regulatory issues: Healthcare organizations that handle medical billing in-house must comply with (and adjust with) complex regulations and standards, which can be extremely hard to navigate and intensely time-consuming. Failure to comply can result in legal and financial penalties, audits, and liability issues.

- Increased risk of errors and denials: In-house billing staff may lack the expertise or resources to effectively manage the billing process, leading to errors and denials. This can result in delayed payments and reduced revenue.

- Understaffing issues: In-house teams are typically small and specialized but lack the manpower/woman power to handle the post-denial process workload, losing significant revenue to a high percentage of good claims that aren’t deemed clean on the first pass.

- Limited scalability: In-house medical billing may be less scalable than outsourcing to a third-party vendor, as healthcare organizations may lack the resources to handle increased or varied billing volume.

Overall, in-house medical billing can be costly and complex, requiring healthcare organizations to invest in staffing, technology, and compliance. Healthcare organizations must carefully consider the pros and cons of in-house billing versus outsourcing to determine the best option for their needs.

OTHER NOTABLE DISADVANTAGES

- The healthcare sector suffered 337 breaches in the first half of 2022 alone, according to Fortified Health Sector’s mid-year report.

- An IBM study revealed that 95% of those data breaches were caused by in-house employee mistakes.

- As in-house billing teams are employees of the organization that they provide billing for, the practice or organization is liable for an mistakes and data issues, absorbing potentially damaging consequences in the form of fines, lawsuits, audits, and published notices of data events to the clients and patients impacted.

Advantages and Drawbacks to Outsourced Medical Billing

ADVANTAGES

- Reduced administrative burden: Outsourcing medical billing and coding can reduce the administrative burden on healthcare organizations, allowing staff to focus on other areas of the practice such as patient care.

- Increased efficiency: Medical billing and coding vendors have expertise and resources to manage the billing process more efficiently, resulting in faster reimbursements and improved revenue cycle management.

- Access to specialized expertise: Medical billing and coding vendors have specialized expertise in coding and compliance, which can help reduce the risk of errors and denials.

- Cost savings: Outsourcing medical billing and coding can result in cost savings for healthcare organizations, as it eliminates the need to hire and train specialized billing staff and invest in technology and infrastructure.

- Improved accuracy: Medical billing and coding vendors have processes in place to ensure accurate coding and billing, which can help reduce errors and denials and improve clean claim rates.

- Scalability: Medical billing and coding vendors can handle increased billing volume, which may not be feasible for in-house billing staff.

- Specialty Expertise: Medical billing and coding can be complex and require specialized expertise. Outsourcing to a vendor with expertise in medical billing and coding can ensure accurate coding, fewer billing errors, and faster reimbursements.

- Faster and Higher Reimbursements: Outsourcing can offer revenue gains in terms of faster reimbursements and better pass-through rates which lead to reduced follow up processing costs.

- Better Support: Outsourcing offers a much higher level of professional support than an in-house billing team can provide, which may impact coding, accuracy, and billing efficiency.

- Compliance and regulatory expertise: Medical billing and coding is subject to complex regulations and standards. Outsourcing to a vendor with expertise in compliance and regulatory requirements can help reduce the risk of legal and financial penalties

- Access to advanced technology: Outsourcing to a vendor can provide access to advanced billing and coding technology that may be too costly for smaller practices to invest in and maintain in-house.

- Reduced Risks: Outsourcing billing puts the onus of data protection and security on the billing company, adding a layer of protection against risk.

DISADVANTAGES

- Lack of total control: Outsourcing medical billing and coding means that a third-party vendor is handling a critical part of the revenue cycle management process. This can result in less control over the process and less oversight of the vendor’s performance.

- Communication issues: Outsourcing can result in communication issues between the healthcare organization and the vendor. This can lead to delays in resolving issues, inaccurate or incomplete billing, and frustration for both parties.

- Transparency: Outsourced billing without financial transparency puts a lot of ability in the hands of the billing company to manipulate data, hide poor performance results, and avoid responsibility for shortcomings.

- Quality concerns: Healthcare organizations may be concerned about the quality of the outsourced billing and coding services. They should evaluate potential vendors’ track record and reputation before deciding.

- Multiple Clients: Outsourced billers handle multiple clients and need to have the staffing and infrastructure to handle all their clients’ needs. The quality of support and communication will be key determining factors in this arena.

Trends and Forecasts

TRENDS

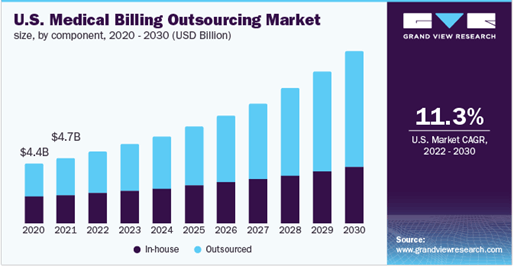

- Outsourced billing growth: Data collected by Grand View Research shows that the global medical billing outsourcing market grew from $13.56 billion in 2022 to $15.12 billion in 2023 at a compound annual growth rate (CAGR) of 11.5%.

- Increased adoption of AI/ML: Outsourced billing companies and services are reaping the benefits of AI/ML supported billing systems, which can streamline the billing process and reduce errors. This trend is driven in part by the increasing push for integrated electronic health records (EHRs) and the need for interoperability between EHRs and billing systems.

- Emphasis on data analytics and reporting: Both in-house and outside billing services are increasingly incorporating data analytics systems and reporting tools to help healthcare organizations identify personalized trends, optimize the peripherals in their revenue cycle management, and improve financial performance by stacking small optimizations.

- Integration with patient engagement tools: In-house billing systems are being integrated with patient engagement tools such as patient portals and mobile apps. This allows patients to view and pay bills online, reducing administrative burden and improving the patient experience.

- Outsourcing of certain billing functions: While some healthcare organizations are keeping billing completely in-house, others are outsourcing certain billing functions, such as coding or claims management, to third-party vendors. This allows healthcare organizations to focus on their core competencies while still benefiting from the expertise and scalability of outside vendors.

- Emphasis on dynamic compliance and regulatory requirements: In-house billing systems are increasingly incorporating dynamic compliance and regulatory tools to update with changes and ensure that billing practices are in line with industry standards and regulations.

FORECASTS

- Increasing adoption of automation: Automation and artificial intelligence (AI) are expected to play a larger role in medical billing in the coming years. This is driven by the need to reduce administrative burden, increase efficiency, and improve accuracy.

- Optimization of value-based care: As healthcare moves deeper into an advanced value-based care model, medical billing will need to evolve to reflect this. This may involve new payment models, such as bundled payments, and new coding and billing practices.

- Increased focus on cybersecurity: With the growing threat of data breaches and cyber-attacks, medical billing will need to place greater emphasis on cybersecurity. This will involve implementing stronger security measures and complying with increasingly stringent data protection regulations.

- Further expansion of telehealth and remote medicine: The pandemic has accelerated the adoption of telehealth, and this trend is expected to continue in the aftermath of a changed medical industry. More telehealth and remote medicine for low priority and diagnostic/intake encounters will require changes to medical billing practices to reflect the unique challenges and opportunities of these new encounters.

- Continued outsourcing of billing functions: Many healthcare organizations are expected to continue outsourcing certain billing functions, such as coding or claims management, to third-party vendors. This will allow healthcare organizations to focus on their core competencies while still benefiting from the expertise and scalability of outside vendors.

- Medical billing services market growth: Globe News Wire projects the medical billing outsourcing market to grow by $11.7 million between 2022-2027, accelerating at a CAGR of 15.73% during the forecast period.

- Medical billing services market share: Data collected by Grand View Research projects a steady upward trend line for the global medical billing outsourcing market to 2030, with in-house billing staying relatively constant.

MEDICAL BILLING LIFECYCLE

Pre-Registration

A crucial initial step in revenue cycle management is capturing patient demographic, insurance, and eligibility data. Claimocity’s medical barcode scanner app streamlines this process, allowing hospitalists to update records and billing information efficiently through quick scans.

Charge Capture

Mobile Charge Capture enables a quicker start to the RCM process by capturing the services with high accuracy at the point of care. Claimocity offers a smart mobile charge capture that uses AI-technology to accelerate the billing workflow and capture the claims with high accuracy in a short period of time. For hospitalists, charge capture software reduces encounters to 15 seconds of total billing and follow up encounters to under two seconds per patient on average. The evolution of smart phones has speed up the billing process with just a single click on the hospitalist mobile application.

Claim Creation and Scrubbing

This is the central core of the Revenue Cycle process, where all the services rendered are translated to appropriate CPT and ICD10 codes with the relevant patient demographic and insurance information along with hospitalist or facility information to generate a claim that needs to be submitted to an insurance firm for payment. Claim scrubbing is done effectively to avoid errors that would contribute to the payer’s claim denial.

Payment Posting

Payment posting in RCM provides clarity on insurance payments in EOBs, payments from patients, insurance checks from ERAs, presents a perfect instance to analyse the medical billing, and increases the account receivables. Predominantly, the medical billing process becomes incomplete without payment posting in RCM.

Accounts Receivable Optimization

An outstanding reimbursement is owed to providers for the services or treatments provided. At Claimocity, our AR experts can follow-up on pending claims, track the reasons for claim denial, track the outstanding receivable amount, etc., and provide detailed reports for the same. Claimocity also provides accounts receivable recovery services, wherein the experts from the AR team will identify the billing operation issue and resolve it at the earliest possible time to avoid non-payment or incorrect payment of claims. Claimocity sends reports to hospitalists about claim status, collection progress, etc.

Denial Management

The denial management process occurs with improperly coded or underpaid claims. In the manual process, most of the denials are never followed up, but the Claimocity best medical billing software ensures follow-up and increases revenue. Patients, providers, and payers are contacted to deal with the denials and improve efficiency.

Strategies to Reduce Denials

Identifying Patient Eligibility

Claimocity RCM tools gather information about patient’s benefits eligibility and health insurance coverage. The practice management software verifies the eligibility and benefits even before the patient is admitted.

Prior Authorization

Our process is pretty much clear so the staff at practices know when to obtain authorization before delivering a service.

Minimize Coding Errors

Our AAPC/AHIMA certified coding professionals will be accountable for reducing coding errors. The automation tools help to take proactive steps to reduce coding errors and improve the efficiency.

Determine Medical Necessity

At times insures might need to reject a claim as the diagnosis code does not support the service that was provided. To avoid this, we use charge capture software to accurately capture the right service for the code given.

Identifying the Causes

Understanding the hidden causes behind the denials requires a complete analysis of the billing process and procedures. The next step in the analysis will be to resolve denial claims more quickly. The experienced team at Claimocity understands the root cause of the issue and ensures that it is fixed quickly.

Categorize

After identifying the denial cause, the next step is to categorise the denial as soft or hard. A soft denial usually has a temporary impact on cash flow, and usually submitting the corrected claim or submitting additional information will be sufficient to get paid in full. Whereas hard denial results in revenue loss and therefore an appeal is needed. At Claimocity the sorting and categorization of denials are done by intelligent automation tools that identifies the denials to revise the process, re-educate employees, hospitalists, and physicians.

Monitoring and Preventing

A Denial management is an ongoing process that must be continuously monitored to prevent any revenue leakage. Our denial management team at Claimocity follow the below steps to prevent revenue leakage:

- A multi-disciplinary team is setup to analyze, categorize the denials based on which further investigation occurs, and discuss their resolution.

- Regular meetings occur to focus on denial category.

A/R Audits

An accounts receivable (AR) audit ensures the accuracy of a company’s records of money owed by customers. It involves reviewing invoices, receipts, and internal controls to identify errors or irregularities. The goal is to improve accuracy, internal controls, and ensure full collection of owed funds. AR audits are conducted by external auditors for independent assessment or by internal audit teams as part of regular financial oversight.

Myths and Misconceptions

Myth 1: Medical billing is a straightforward process.

Reality: Medical billing is complex, detail-driven, and involves multiple stakeholders with varying requirements. It’s often inefficient due to manual processes and evolving reimbursement rules, leading to errors and financial risks.

Myth 2: Medical billing is a one-time process.

Reality: Medical billing is ongoing, involving multiple cycles, appeals, and negotiations with insurers. Specialists must stay updated on regulations and dedicate resources to thorough investigations and claim adjustments.

Myth 3: Medical billing is a low-skilled job.

Reality: Medical billing demands specialized knowledge of terminology, codes, regulations, and strong communication skills. Different specialties require tailored expertise, distinguishing between office and facility billing.

Myth 4: Most medical billing is good enough.

Reality: While outsourced billing often meets average standards, the gap between average and excellent is significant. Deception and errors are common, with some companies neglecting follow-ups and shifting responsibilities. Lack of transparency can lead to significant revenue losses for providers.

How Much to Pay for Outsourced Medical Billing?

Generally, medical billing companies charge a percentage of the practice’s collections or a flat fee per claim. The percentage typically ranges from 5% to 10% of the practice’s collections, while the flat fee per claim can range from $5 to $10 or more.

Flat fees are usually a bad strategy as they end up far more costly on average. They are designed to be proportional to the contracted rate but end up coming out of the collected rate. For example, a contracted rate of $100, keeps the $4-10 flat fee at the same 4-10% range, but actual collections are often below the contracted rate, so if the actual collection is $78, then the $4-10 flat fee balloons to 5-13% per claim.

Tip: When negotiating percentages, fractional percentage points matter. When you have gotten what you feel is the best quote for the service you prefer, complete the negotiations by asking for a final quarter percentage point off to close the deal. Either they will be unable to go lower which typically indicates you have already achieved the best rate possible, or they will agree because there was some slight flexibility built in and you will save tens of thousands over the life of the service.

Tip: This one is more common knowledge, but the percentage is typically based on volume and the higher the volume of encounters across all the providers, the better your rate should be. While 9-10% may be within typical ranges, they are too high for the market and should be negotiated down.

- Smaller or solo practices should negotiate towards the 7-8% mark based on volume.

- Medium practices should negotiate towards the 6-7% mark based on volume.

- Larger practices should negotiate towards the 5-6% mark based on volume.

- The 4-5% percentages are typically reserved for enterprise practices as the margins are much slimmer for the biller, but they make up for the loss on volume.

- And don’t forget to try and get an extra quarter percent point (0.25%) off as the last step before signing.

13 Tips for Choosing the Right Medical Billing Solution

- Features: Consider what features the medical billing solution offers and whether they align with your needs. Look for features such as claims management, patient billing, claims tracking, patient eligibility verification, payment processing, denial management, and reporting.

- Ease of use: Choose a medical billing solution that is easy to use and intuitive for your staff. This can help reduce errors and increase productivity.

- Integration: Look for a medical billing solution that can integrate with your electronic health record (EHR) system, practice management software, and other tools you use in your practice. This can help streamline your billing process and improve accuracy.

- Customer support: Ensure that the medical billing solution you choose offers strong customer support, quick response times, personalized service, and training resources to help you and your staff navigate the system.

- Cost: Consider the cost of the medical billing solution and whether it is within your budget. Be sure to factor in any additional costs, such as implementation, training, and ongoing support.

- Security: Ensure that the medical billing solution you choose has strong security measures in place to protect sensitive patient information.

- Reputation: Look for a medical billing solution with a good reputation in the industry and positive reviews from other healthcare providers.

- Referrals: It may also be helpful to consult with colleagues or industry experts for recommendations and insights.

- Initial AR audit: This won’t help in the decision process but a clear indicator of both the quality of the new billing vs the quality of the old billing is the amount of A/R they can process and save from expiring that was left unprocessed and expiring by the prior option.

- Compatibility: Ensure that the billing solution is compatible with your existing electronic health records (EHR) system or practice management software. This will help to streamline the billing process and reduce the risk of errors.

- Specialty driven: Some systems work well for some specialties and poorly for others. Hospitalists in the past have been forced to utilize billing and PM software that wasn’t designed for their needs, resulting in paying premiums for fractional value.

- Compliance: Verify that the billing solution complies with all relevant regulatory standards, such as HIPAA and CMS regulations. This will help to ensure that your organization is compliant and help reduce the risk of penalties or fines.

- Scalability: Consider the ability of the medical billing solution to scale with your organization’s needs, including adding new providers or services.

Scientific Studies & Case Studies Referenced

Scientific Studies

In addition to the journal articles and studies listed in the notable statistics section, here are a handful of the other articles explored for this guide.

- Journal of Healthcare Management (2005): “Outsourcing medical billing and coding: an exploratory study of industry practices and effects” by James A. Johnson and Nora C. Johnson. The study examined the outsourcing of medical billing and coding services in the healthcare industry and found that outsourcing can reduce costs and improve efficiency, but also poses risks related to quality control and data security.

- Journal of Medical Systems (2019): Analyzing the impact of outsourcing medical billing and coding services on the financial performance of physician practices, the study discovered that outsourcing billing and coding services improved the revenue cycle management process and increased the overall financial performance of the practices.

- Journal of Medical Systems (2016): “The impact of electronic health records and billing systems on the quality of patient care: a systematic review” by Stefano Bonacina et al. The study reviewed the impact of electronic health records (EHRs) and billing systems on patient care quality and found that EHRs can improve clinical decision-making and care coordination, but also pose challenges related to data quality, privacy, and security.

- Journal of Health Care Finance (2016): Comparing the cost and quality of in-house medical billing versus outsourced medical billing, they found that outsourcing medical billing was less costly and resulted in higher quality billing services compared to in-house billing.

- Journal of Health Care Finance (2003): “Electronic versus paper-based billing: differences in service utilization, coding, and payer mix” by Sara Rosenbaum et al. The study compared electronic and paper-based billing systems and found that electronic billing resulted in higher rates of claim acceptance, faster payment times, and lower administrative costs.

- Journal of Healthcare Management (2015): Analyzing the impact of implementing electronic medical billing systems on the efficiency and revenue of a hospital’s billing department, this study discovered that electronic medical billing systems connected with billing systems improved billing efficiency and increased revenue for the hospital.

- Journal of Medical Practice Management (2013): Digging into the impact of physician education on billing and coding accuracy, they found that physician education on billing and coding resulted in improved accuracy and decreased claim denials.

- Archives of Internal Medicine (2003): “Accuracy of medical claims data: the feasibility of electronic medical records in a payer-based setting” by Randall S. Stafford et al. The study compared the accuracy of claims data in electronic medical records (EMRs) and paper-based records and found that EMRs had higher accuracy rates and lower error rates than paper-based records.

Case Studies

In addition to internal case studies conducted on new clients switching from in-house to outside billing services, we explored independent 3rd party surveys and published case studies.

- “Revenue Cycle Management Optimization and Technology Implementation in a Mid-Sized Primary Care Practice” by Andrew Cantor, published in the Journal of Healthcare Information Management in 2018. The case study describes the implementation of a revenue cycle management system in a primary care practice, resulting in increased revenue, improved claims processing times, and reduced administrative burden.

- “Outsourcing Medical Billing to Improve Cash Flow and Reduce Costs” by Hadi R. Maktabi and Mohammad Yamin, published in the Journal of Healthcare Management in 2011. The case study describes the outsourcing of medical billing services by a large medical group, resulting in increased revenue, reduced billing errors, and improved collections.

- “Implementation of an Electronic Health Record and Billing System in a Federally Qualified Health Center” by Christina T. Rosenthal et al., published in the Journal of Health Care for the Poor and Underserved in 2014. The case study describes the implementation of an electronic health record and billing system in a federally qualified health center, resulting in improved documentation, increased revenue, and enhanced patient care.

- “Streamlining the Revenue Cycle: An Integrated Approach to Revenue Cycle Management” by Nayan Patel and Anthony Avitabile, published in the Journal of Healthcare Information Management in 2017. The case study describes the implementation of an integrated revenue cycle management system in a large academic medical center, resulting in improved charge capture, reduced denials, and increased revenue.