Claimocity Claims

How MDs are Minimizing Revenue Losses During COVID

In normal times, the average doctor loses between 10-22% of their income to inefficiency, with poorly run practices losing up to a third or more.

This includes missed charges, lost charges, errors, missed deadlines, coding issues, denials, time costs, software issues, organizational deficiencies, opportunity costs, and unnecessary administrative burdens.

During times of crisis, inefficiencies are magnified and practices

that weren’t already operating at high levels are in trouble.

For even well-run practices, the inefficiency percentage has ballooned in recent weeks, eating up a much larger percentage of the reduced income levels.

- Non-COVID 19 patients are staying home.

- Facility censuses are down, and most facilities are requiring telehealth visits.

- For physicians relatively new to telemedicine, the implementation, learning curve, comfortability, and changes to billing have all come with slowdowns that are having an impact on revenue generation.

Healthcare Billing Amidst a Shifting Landscape

The impacts of the shifting healthcare landscape are being felt in every specialty, with perhaps the exception of psychiatry, where patients are more vulnerable to stress and the pandemic is driving the numbers up.

- To add another layer of difficulty to the revenue cycle growth process, the insurance companies have become even slower to process claims and provide administrative support on resolutions, appeals, and interactions.

During the current pandemic, with their employees working remotely, the insurance reps are providing the bare minimum, which is really revealing which billing teams have the experience, staffing, and expertise necessary to thrive in times of crisis.

- Medical billing staff have also had to transition to remote work and if they did not have an efficient infrastructure and the appropriate QA/QC measures in place, you can add their inefficiencies to the growing pile.

Quantifying the Impact

Consider a 10% inefficiency rate for a practice generating 3.5M annually.

Prior to the pandemic they should have been generating about 292K monthly but with just under 30K in losses due to inefficiency, they were actually generating 262.5K monthly.

During the first 30 days of the crisis, that 10% inefficiency has spiked to 30% because of the added telemedicine issues, shifting work structures, learning curves, insurance company issues, and billing company transitions.

Revenue Losses Amidst Healthcare Crisis

With the number of billable visits cut in half, revenue has dropped to a maximum level of 146K monthly, but while revenue has dropped, the monthly inefficiency losses have grown to 43.8K, meaning that take home revenue has dropped from the original 262.5K to a crushing 102.2K.

Where 30K in lost income was only 11.43% of the revenue, now 43.8K in lost wages translates to a 42.85% of the current payable income. Losing nearly half of all revenue that has been earned is unacceptable. In the best of times physicians deserve to collect what they have earned for encounters they have completed, and it becomes even more important in times of crisis.

keys to minimizing the damage

The first step is to accept that the crisis is having a measurable impact and instead of taking steps to try and generate income levels comparable to non-COVID-19 months, the focus and mindset needs to be on maximizing every billable dollar from the visits they have left.

The second step needs to be understanding that a proactive telehealth mindset can be a beneficial one as the relaxed rules for these visits actually provide strong opportunities for optimal coding and billing without all of the prior regulation.

The third and most crucial step is properly evaluating the billing team and software you are using in order to make a data-driven decision as to whether your current end-to-end billing solution is rising to the challenge or showing cracks in their foundation.

A few simple questions to ask

- Is it saving or costing me crucial time? Am I frustrated by how long certain tasks take?

- Is it quickly and easily processing charges or generating administrative burdens? Do I feel like there is a better use for my time?

- Is telehealth billing built into the software or are they scrambling to add it?

A few factors to consider

Many billing companies employ the bare minimum number of employees and only work standard hours, which makes it difficult to push issues through insurance company bureaucracies in the best of times.

Support which may seem robust during optimal times is going to be stretched thin and employees unused to working from home will struggle in the new framework with losses of connectivity, home distractions, and less incentive to perform at higher levels.

Here is what is working for us here at Claimocity.

Highest efficiency markers in the industry.

While the industry average for inefficiency is 10-22%, at Claimocity we are driven by efficiency as the first stage of our revenue cycle management process and are able to achieve 2-3% in the short term trending towards 1% in the long term.

By eliminating revenue losses due to inefficiency, we are able to immediately generate higher income levels for our clients within the first month. This provides the foundation we use to build long term sustainable revenue growth.

Better yet, because we were well equipped with a telemedicine infrastructure, have a robust billing staff, and already focus everything we do on time management, efficiency, and revenue growth, our inefficiency rates have not spiked during the crisis, and our physicians are earning the highest amounts possible within the structure of the reduced visits while being set up for a fast return to higher revenue earnings when the pandemic passes.

Telehealth billing built in.

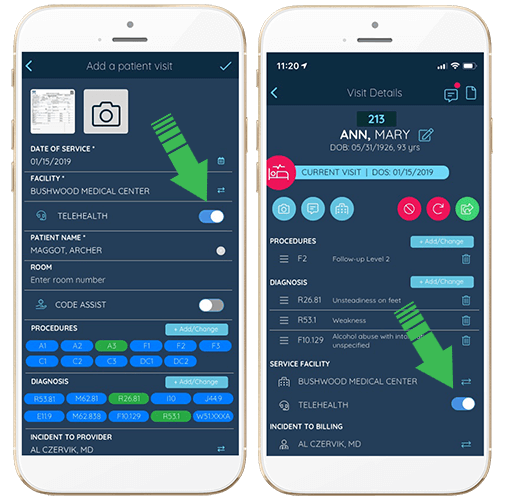

Long before the crisis, we recognized the trend towards telehealth and have the most simple and elegant billing solution built into the app. A simple tap switches a visit between the assigned facility and a remote visit, allowing you to bill for telehealth in under one second.

Plus, our award-winning billing teams run constant QA/QC checks on all telemedicine visits, providing proactive notifications to the doctors at the point of care to ensure they optimize the coding and billable revenue generation.

Time saving is our primary focus.

Well before COVID-19 turned the world upside down, we recognized the main focus of hospitalist software should be to get doctors paid for every visit they perform without exception. We don’t believe that inefficiency levels are a given and have focused all of our AI-enhanced efforts towards generating maximum revenue growth levels.

Streamlining Operations for Maximum Revenue Recovery

One of the biggest ways we have reduced inefficiency is by eliminating wasted time.

Every tool we provide is simple, easy to use, and fast.

For example, our accelerated mobile charge capture not only reduces billing to an average of 9 seconds per patient but generates the highest levels of found and corrected charges in the industry, practically eliminating the revenue inefficiency from lost or missing claims.

Unrivaled concierge support and quality control.

When this is combined with the quality control and statistical analyses from our machine learning algorithm and around the clock concierge billing support (that move through your day with you checking all the incoming data as it flows in) you get a very efficient system that is able to generate the highest benchmarks not just for hospitalists but physiatrists, hospital psychiatrists, anesthesiologists, endocrinologists, pain management specialists, and just about any specialty that sees 25% or more of their patients in (out of office) facilities or during hospital rounds.

Not only will this step be important for effectively minimizing the damage for the duration of the current crisis, but vital to setting physicians up for the fastest and largest revenue generation recovery outcome in the post crisis rebuilding phase.

To reiterate

The COVID 19 impact on the revenue cycle for hospitals and their healthcare providers is both undeniable and dynamic, evolving in unprecedented manners as the world adapts to the economic and social ramifications of the pandemic.

But how are some hospitalists and healthcare providers capitalizing upon the fluid situation to generate higher bottom line income while the clear majority are experiencing dramatic drops in claims, revenue per encounter, and total revenue?

THE ANSWER

First, the efficiency of the billing, namely the ability to process higher numbers of visits and encounters while capturing claims in a quick efficient fashion followed by generating the highest levels of returns on claims.

Next there was a direct correlation between higher income and not being unnecessarily bogged down by paperwork and administrative tasks in the complex rules of the changing revenue cycle system.

Stronger time management efficiency not only generated better revenue per encounter, it enabled a higher number of visits, offsetting the inevitable array of issues that every healthcare provider is having to adjust to.

Experience the difference for yourself

At Claimocity, our doctors on average are seeing the lowest revenue loss figures across the board according to the data gathered for the following specialties: internal medicine, infectious disease, hospital psychiatry, physiatry (PM&R), cardiology, gastroenterology, pulmonology, nephrology, anesthesiology, pain management, urgent care, emergency medicine, hospitalists, and doctors who spend more than 25% of their time making rounds or seeing patients outside of the office.

Best of all, because efficiency and user-friendliness go hand in hand (the better you can intuitively use something the faster and more efficient you will be with it), the learning curve on the software is negligible and physicians who sign up can expect to be up to speed almost immediately, with our around the clock support always available to answer questions, provide timely tips, and offer friendly and knowledgeable person to person assistance.

We don’t use pressure filled sales techniques or bombard you to sign up, merely show you the software in a quick easy demo, answer any questions you may have, provide some benchmarks for where you are at and what you can expect, and then let you decide for yourself whether you want to make the change.